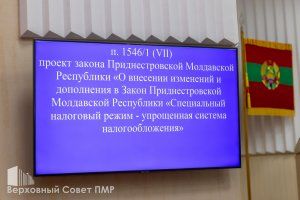

The Supreme Council of the Pridnestrovian Moldavian Republic adopted amendments to the legislation in two readings at once, which will allow individual entrepreneurs and organizations operating under the simplified taxation system to continue working in this tax system in the event of late payment of taxes. An entrepreneur lost the right to work under the simplified taxation system from the following year if he allowed late payment of taxes and other mandatory payments to the budget and extra-budgetary funds for a period of 30 calendar days or more according to the provisions of the law "Special tax regime – simplified taxation system" until now.

Amendments to the tax legislation, which soften the current provisions of the law on the simplified taxation system, were developed based on appeals from entrepreneurs by parliamentarians Viktor Guzun, Galina Antyufeeva and Vadim Kravchuk. Late payment of tax payments for a period of 30 calendar days or more is excluded from the list of conditions for terminating the application of the simplified taxation system in the specialized law. The second law-in-draft introduced clause 2-1 of Article 15.5 into the Code of Administrative Offenses. It introduces fines for failure to fulfill the obligation to pay taxes and other mandatory payments for organizations and individual entrepreneurs operating under the simplified taxation system, since this is a violation of tax legislation. The obligation to pay tax arrears will remain.

Organizations operating under the simplified taxation system are faced with situations when they cannot pay taxes on time in the current economic realities due to late payments by counterparties.

According to the adopted amendments to the Code of Administrative Offenses, if tax payments are overdue for more than 3 months and the amount of overdue payments exceeds 100 minimum wages, penalties are introduced. The amounts of fines vary. From 50 to 100 minimum wages for individual entrepreneurs, for officials – from 100 to 200 minimum wages, for legal entities – from 300 to 350 minimum wages. According to the law "On the republican budget for 2025", 1 minimum wage for fines is equal to 18.4 rubles.

Amendments to the law "Special tax regime – simplified taxation system" and to the Code of Administrative Offenses were adopted by the Supreme Council of the PMR in two readings at once. The norms will come into force immediately after signing by the President of the PMR. Amendments to the law "Special tax regime – simplified taxation system" will apply to legal relations that arose from January 1, 2024.

Законы ПМР

Законы ПМР Постановления

Постановления Законопроекты

Законопроекты Анонс мероприятий

Анонс мероприятий 0 (533) 6-24-24

0 (533) 6-24-24